How Secondary Demat Account Can Save You Lakhs in Taxes

Zerodha has introduced a Secondary Demat Account feature – a huge win for investors who juggle both long-term holdings and short-term trades.

And if you don’t use Zerodha, no worries. You can still achieve the same benefit by simply opening two separate demat accounts with your broker instead of using just one. The idea is the same: keep investments and trades apart so your long-term gains don’t get taxed as short-term under FIFO rules.

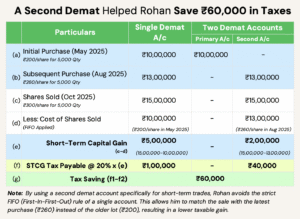

We analysed a case where investor Rohan (imaginary investor) ended up paying lakhs of extra tax only because all his shares sat in one account. With a secondary demat, that problem disappears.

The Problem with FIFO in a Single Demat

When you hold all your shares in a single demat, FIFO (First-In-First-Out) rules apply. This means whenever you sell, the system assumes you are selling the oldest lot first.

For active investors, this is a problem. Your long-term, low-cost investments often get sold “on paper” before your newer trades, pushing up your short-term capital gains (STCG) bill unnecessarily.

How Rohan Paid Extra Tax

Let’s say Rohan made these trades:

-

May 2025: Bought 5,000 shares at ₹200 each → ₹10,00,000

-

August 2025: Bought another 5,000 shares at ₹260 each → ₹13,00,000

-

October 2025: Sold 5,000 shares at ₹300 each → ₹15,00,000

If all shares are in a single demat:

- FIFO applies → May 2025 lot (₹200/share) is sold

-

Cost = ₹10,00,000

-

Sale = ₹15,00,000

-

Total Short-Term Capital Gain = ₹5,00,000

-

STCG Tax @ 20% = ₹1,00,000

If shares are split across two demats:

-

May 2025 lot sits in the primary account (kept as long-term investment)

-

August 2025 lot sits in the secondary account (used for short-term investment)

-

Sale in October is from the secondary account → FIFO applies here, so cost = ₹13,00,000

-

Sale = ₹15,00,000

-

Total Short-Term Capital Gain = ₹2,00,000

-

STCG Tax @ 20% = ₹40,000

Just by using a secondary demat, Rohan saves ₹60,000 in tax in a single transaction.

Preserving Long-Term Gains

Now imagine if Rohan sells his May 2025 lot later in June 2026 at ₹350 per share:

-

Cost = ₹10,00,000

-

Sale = ₹17,50,000

-

Total Long-Term Capital Gain = ₹7,50,000

-

Taxed as LTCG @ 12.5% (after ₹1.25 lakh exemption) ≈ ₹75,000

Since he held the shares for more than 12 months, this qualifies as Long-Term Capital Gain (LTCG). Now, imagine if the same lot had been compulsorily sold earlier under FIFO rules. In that case, it would have been treated as Short-Term Capital Gain (STCG) and taxed at 20% – meaning a much higher tax outgo.

Why This Works

-

FIFO runs separately in each demat → your long-term and short-term positions stay ring-fenced.

-

Off-market transfers between your own demats are not taxable.

-

You still see both demats under one Zerodha Console login.

Costs and Caveats

-

AMC: Approx. ₹300 + GST per demat

- Transfer Fee: Approx.₹25 + GST per off-market transfer

-

BSDA Loss: Holding more than one demat means you can’t claim BSDA (Basic Services Demat Account) benefits, which are meant for small investors with holdings under ₹2 lakh.

The Takeaway

With just one smart step – opening a secondary demat – Rohan:

- Saved ₹60,000 immediately in October 2025

-

Preserved his long-term capital gains benefit instead of paying 20% STCG in June 2026

For active investors, this isn’t a one-time trick. Over time, keeping trades and investments in separate demats can help save lakhs in taxes year after year.

Disclaimer:

This article is for general informational purposes only and should not be considered professional advice. Please consult a qualified expert for advice tailored to your specific situation. The author and website owner are not liable for any errors or actions based on this content.