Relief for TDS/TCS Defaults Due to Inoperative PAN: CBDT Circular No. 9/2025

July 22, 2025

The Central Board of Direct Taxes (CBDT) has issued Circular No. 9/2025 dated 21st July 2025, providing partial modifications to its earlier circulars to offer relief to deductors and collectors facing demands due to TDS/TCS defaults caused by inoperative PANs. This move aims to address numerous grievances raised by taxpayers regarding demands for short-deductions or collections, even in cases where the PAN was later made operative.

This blog outlines the implications, relief measures, and compliance expectations stemming from the new circular.

Circular No. 3/2023 (dated 28th March 2023) had specified that if PAN becomes inoperative (under Rule 114AAA of the Income-tax Rules, 1962), higher TDS/TCS rates under Section 206AA/206CC would apply from July 01, 2023 onwards, until the PAN is made operative.

Circular No. 6/2024 (dated 23rd April 2024) provided temporary relief for transactions done up to March 31, 2024, if the PAN was linked with Aadhaar by May 31, 2024.

However, many deductors/collectors have received notices for short deduction or collection, despite the PAN becoming operative later, leading to avoidable tax demands.

The Issue with Inoperative PAN:

As per Circular No. 3 of 2023, if a PAN is not linked with Aadhaar, it becomes inoperative from July 1, 2023.

Consequences include:

• No tax refunds while PAN is inoperative.

• No interest on refunds for the inoperative period.

• TDS/TCS must be deducted/collected at higher rates under sections 206AA/206CC of the Income-tax Act.

To mitigate hardships, CBDT has introduced two key relaxations for cases where PANs became operative due to Aadhaar linkage after the transaction dates:

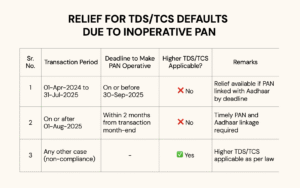

No higher TDS/TCS liability will arise in the following two situations:

Payments/Credits between April 1, 2024 and July 31, 2025

➤ Condition: PAN must be made operative on or before September 30, 2025.

Payments/Credits on or after August 1, 2025

➤ Condition: PAN must be made operative within 2 months from the end of the month in which the amount was paid/credited.

In such cases, higher TDS/TCS under Section 206AA/206CC will not apply, and no default will be treated for the deductor/collector.

• For deductors/collectors:

Review TDS/TCS statements, communicate with clients/vendors whose PAN was previously inoperative, and encourage prompt PAN–Aadhaar linkage.

• For taxpayers:

Check your PAN–Aadhaar linkage status immediately if there is any doubt.

Notes:

This circular reinforces the government’s intent to balance compliance with taxpayer convenience. While PAN-Aadhaar linkage remains mandatory, the latest relief provides much-needed protection for deductors/collectors from unjust demands, provided they meet the revised deadlines.

Download official circular from government by clicking here.

For assistance with PAN-Aadhaar linking or resolving TDS/TCS defaults, feel free to ask in comment section.

Disclaimer:

This article is for general informational purposes only and should not be considered professional advice. Please consult a qualified expert for advice tailored to your specific situation. The author and website owner are not liable for any errors or actions based on this content.